Expert Insights: What You Required to Find Out About Credit Repair Providers

Expert Insights: What You Required to Find Out About Credit Repair Providers

Blog Article

A Comprehensive Overview to Just How Credit Repair Can Change Your Credit Report

Recognizing the complexities of credit fixing is essential for anyone seeking to improve their financial standing - Credit Repair. By dealing with problems such as payment background and credit usage, individuals can take proactive actions toward boosting their credit history. The process is frequently fraught with misconceptions and potential risks that can impede progression. This overview will brighten the key strategies and factors to consider needed for effective credit scores repair, eventually disclosing how these initiatives can lead to more favorable financial opportunities. What remains to be discovered are the details activities that can set one on the path to a more durable credit rating account.

Comprehending Credit History

Understanding credit report is essential for any individual seeking to improve their financial wellness and gain access to better loaning choices. A credit report is a mathematical representation of an individual's creditworthiness, commonly varying from 300 to 850. This score is generated based on the details had in an individual's credit history report, which includes their credit report history, outstanding financial debts, payment history, and kinds of charge account.

Lenders use credit history to evaluate the danger related to offering money or extending credit rating. Higher ratings show lower risk, commonly resulting in more desirable financing terms, such as reduced rate of interest and greater credit limits. Alternatively, reduced credit report can cause higher interest prices or rejection of credit report altogether.

A number of factors affect credit ratings, consisting of settlement history, which makes up around 35% of ball game, followed by credit rating utilization (30%), length of credit scores history (15%), types of debt in use (10%), and new debt questions (10%) Recognizing these factors can equip individuals to take workable steps to boost their scores, inevitably boosting their economic opportunities and security. Credit Repair.

Common Credit Score Issues

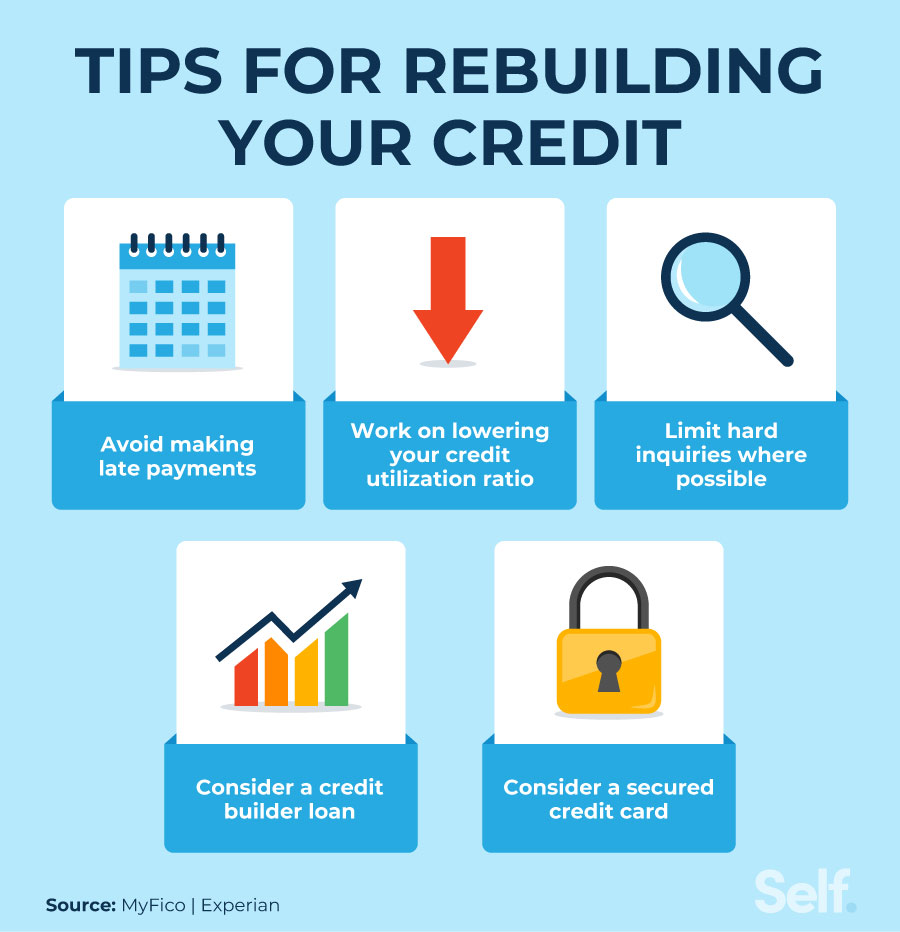

Many people deal with typical credit score concerns that can impede their monetary development and affect their credit history scores. One prevalent issue is late repayments, which can considerably harm credit scores scores. Even a single late settlement can continue to be on a credit score record for a number of years, affecting future borrowing potential.

Identity burglary is an additional major concern, potentially leading to illegal accounts showing up on one's credit record. Resolving these usual credit rating concerns is crucial to boosting economic health and establishing a strong credit scores account.

The Credit Rating Repair Process

Although credit report repair can seem complicated, it is a methodical procedure that individuals can take on to improve their credit history ratings and remedy inaccuracies on their credit history reports. The first step entails obtaining a copy of your credit scores record from the three significant credit rating bureaus: Experian, TransUnion, and Equifax. Testimonial these records diligently for inconsistencies or mistakes, such as inaccurate account information or obsolete details.

Once mistakes are recognized, the next action is to dispute these mistakes. This can be done by contacting the click for more info credit report bureaus directly, giving documents that supports your insurance claim. The bureaus are needed to check out disputes within 1 month.

Preserving a constant settlement history and handling debt usage is likewise crucial throughout this procedure. Checking your credit rating regularly makes sure recurring precision and assists track enhancements over time, reinforcing the effectiveness of your debt repair service efforts. Credit Repair.

Benefits of Credit Report Repair

The advantages of credit repair service expand much beyond simply enhancing one's debt rating; they can significantly impact financial security and opportunities. By addressing mistakes and adverse products on a credit history report, individuals can improve their credit reliability, making them a lot more eye-catching to loan providers and financial institutions. This improvement commonly causes far better rates of interest on loans, lower premiums for insurance, and boosted chances of approval for credit cards and home mortgages.

Furthermore, credit history fixing can assist in accessibility to crucial solutions that call for a credit scores check, such as renting out a home or acquiring an energy service. With a healthier credit score profile, people might experience enhanced self-confidence in their financial choices, enabling them to make larger acquisitions or investments that were formerly unreachable.

Along with substantial economic benefits, credit report repair cultivates a feeling of empowerment. Individuals take control of their financial future by proactively managing their credit score, leading to even more informed selections and higher monetary proficiency. In general, the advantages of credit history fixing add to a much more stable monetary landscape, eventually promoting long-term economic development and individual success.

Choosing a Credit History Repair Solution

Choosing a credit history repair work solution calls for careful consideration to make sure that people obtain the assistance they require to improve their economic standing. Begin by useful source looking into potential firms, concentrating on those with favorable client reviews and a tested record of success. Transparency is key; a reputable service must plainly describe their timelines, processes, and charges upfront.

Following, confirm that the credit history repair service complies with the Credit report Repair Work Organizations Act (CROA) This federal legislation secures customers from deceitful practices and sets standards for credit history repair service services. Prevent companies that make impractical promises, such as guaranteeing a details rating boost or declaring they can get rid of all negative items from your report.

Furthermore, consider the degree of customer support supplied. A great credit scores fixing solution should give customized help, enabling you to ask questions and obtain timely updates on your progression. Seek solutions that offer an extensive analysis of your credit history record and create a personalized approach customized to your details situation.

Eventually, choosing the right credit fixing solution can lead to considerable improvements in your credit history score, equipping you to take control of your economic future.

Conclusion

In final thought, effective credit rating repair work methods can substantially boost credit rating by resolving common issues such as late settlements and errors. A detailed understanding of credit history aspects, incorporated with the engagement of trusted credit score repair solutions, facilitates the settlement of unfavorable items and continuous progress tracking. Eventually, the successful enhancement of credit rating scores not only leads to far better finance terms however likewise cultivates greater monetary opportunities and security, emphasizing the importance of positive credit score monitoring.

By attending to problems such as payment background and credit rating use, people can take aggressive steps toward enhancing their credit rating ratings.Lenders use debt scores to assess the danger linked with providing cash or expanding credit.Another frequent issue is high this content credit history usage, specified as the ratio of existing debt card equilibriums to total readily available credit history.Although credit scores repair work can seem overwhelming, it is a systematic procedure that people can undertake to boost their credit report scores and fix mistakes on their debt reports.Next, confirm that the credit score fixing solution complies with the Credit scores Repair Organizations Act (CROA)

Report this page